|

Michael A. Stecker

mastecker@gmail.com

|

|

|

|

2955 Motor Ave. Los

Angeles, CA 90064

Price Estimates |

|

|

|

Home 2955 Motor Painting

Fall-2015

2955 Motor photos

Cheviot Hills

Homes

San Diego Homes |

|

|

|

2955 Motor Avenue, Los Angeles, California 90064 (Cheviot

Hills) in December, 2015

|

| |

| |

|

Redfin estimates on

2955 Motor Avenue, Los Angeles, CA 90064

.Redfin Estimate, 10-2014:

$1,582,00

Redfin estimate, 12-2015: $1,819,407

Redfin estimate, 6-2017: $2,042,500

Redfin estimate, Jan 6, 2018:

$2,101,857

https://www.redfin.com/CA/Los-Angeles/2955-Motor-Ave-90064/home/6797830#redfin-estimate

|

| |

| |

|

Estimate on 2955 Motor Ave. if

sold at $1,675,000 in June, 2017 "as

is" cash deal

with no realtor commission

Possible Property Selling Price of $1,675,000 (in

June, 2017, no commission)

Less Outstanding WF mortgage loan: $9,500 (as of June,

2017)

Gross Equity: $1,665,500

Closing Costs estimate, June, 2017

County Transfer tax: &1842.50

City Transfer Tax: 7,537.50

Grant Deed: 28.00

Sub-Escrow: 62.50

Title Wire Fee: 30.00

Recording Service Fee: 9.50

Settlement Agent Fee: 3,550.00

Processing Fee: 175.00

Prepare Grant Deed: 125.00

Messenger Fee: 50.00

Natural Hazard Report Fee: 74.95

City Report, Dept. of Building and Safety: 70.85

Certificate, LA Department of Water and Power: 15.00

TC Feee: 790.00

Total: $14,361

Net Equity for (June, 2017) is 1,665,500 - 14,361:

$1,651,139

Taxes:

Tax rate for sale of my house at over

$1,000,000 is:

Federal: 20% cap gains plus 3.8% ObamaCare = 23.8%

California state tax is 11.2%

Total tax rate is: 35% (on taxable amount)

Taxable amount is:

(for June, 2017 selling price of $1,675,000)

$1,651,139 - $200,000 (price I paid for house in April, 1979) - $250,000

deductible for single owner - $10,000 (improvements) = $1,191,139

Total taxes if house sold for $1,675,000 in June, 2017

is:

$416,899

(Fed capital gains + Obama Care & California or 1,191,139 X

0.35 = $416,899)

So if my house sells in June, 2017 for $1,675,000 ($1,651,139 net

equity after I pay off the $9,500 mortgage & deduct closing costs),

the Net after taxes is about $1,651,139 - 416,899

= $1,234,240

Net for sale of 2955 Motor for a $1,675,000 offer in

June, 2017:

$1,234,240

(-26.3% from selling price)

|

| |

| |

| |

|

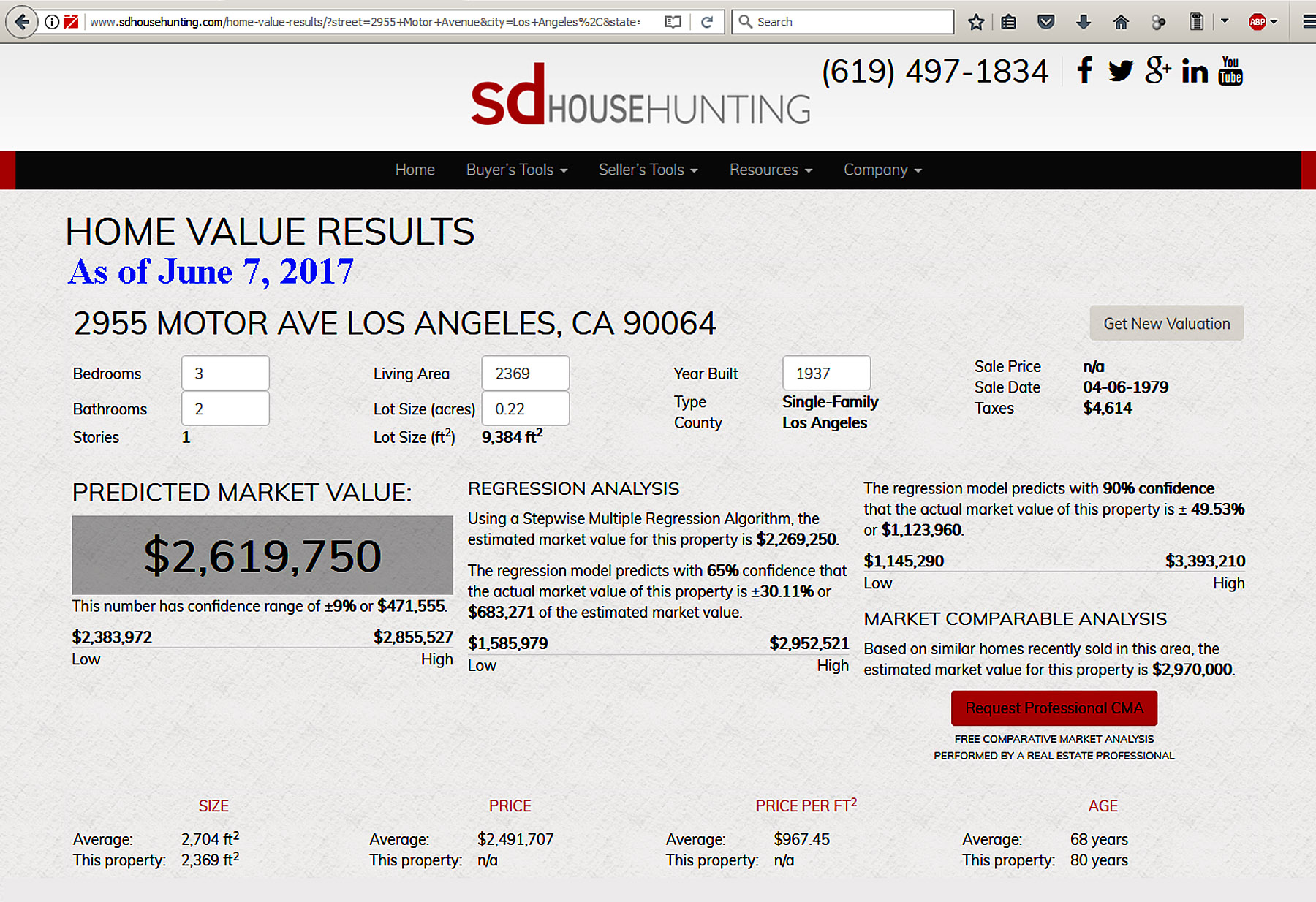

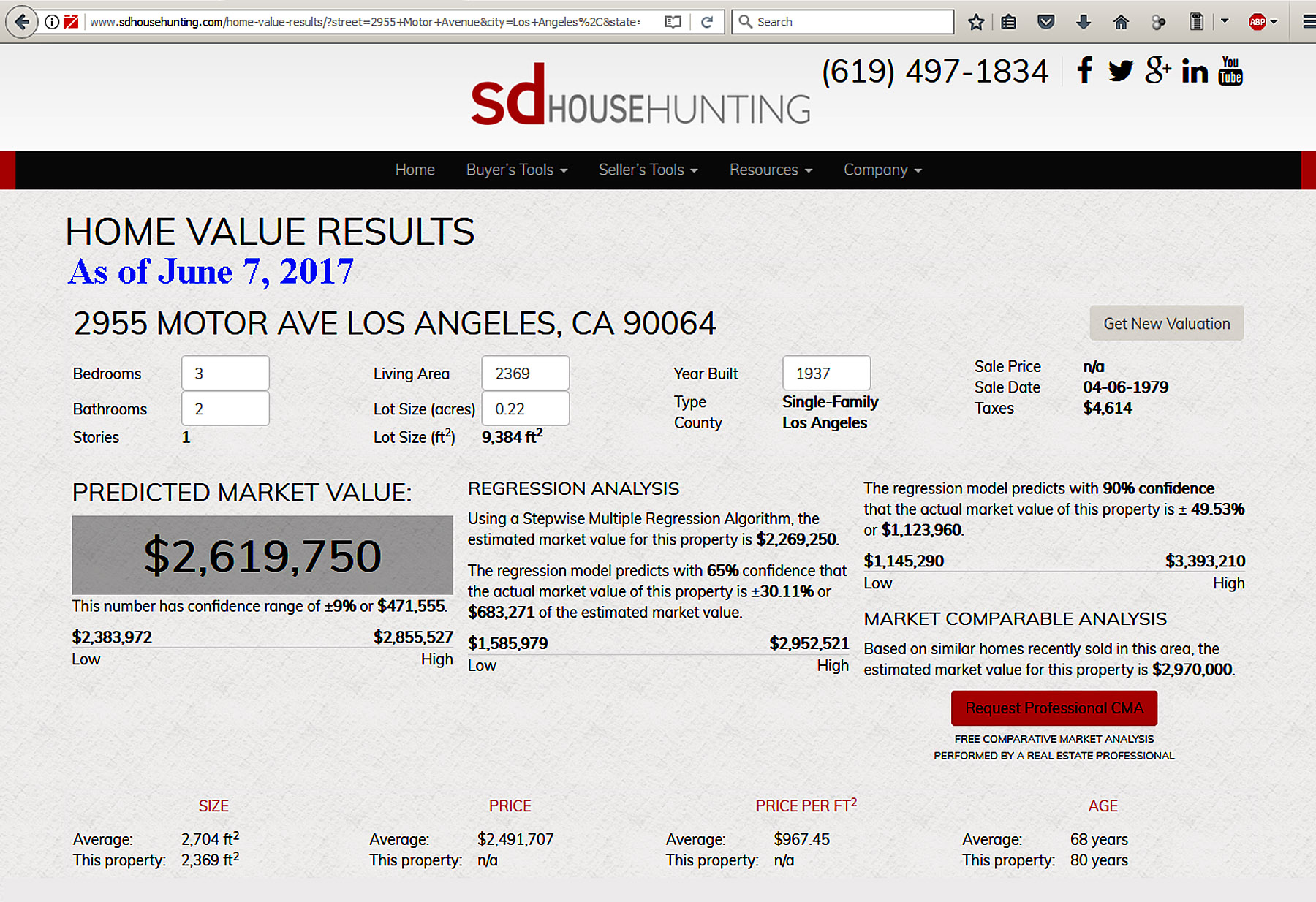

SD HouseHunting estimate on 2955 Motor Avenue, Los Angeles, CA 90064 in

June, 2017

http://www.sdhousehunting.com/ |

|

2955 Motor Ave. home value estimate -- June 7, 2017

http://www.sdhousehunting.com/home-value-results/?street=2955+Motor+Avenue&city=Los+Angeles%2C&state=CA&zip=90064

.

SD HouseHunting Estimate on 2955 Motor Ave. Los Angeles 90064, 12-2015:

$2,038,750

SD HouseHunting Estimate on 2955 Motor Ave. Los Angeles 90064, 3-2016:

$2,106,000

($67,250 appreciation over 3 months or 22,000 per month

recent gain)

SD HouseHunting Estimate on 2955 Motor Ave. Los

Angeles 90064, June 2, 2017:

$2,619,750

+/ - 9%

http://www.sdhousehunting.com/home-value-results/?street=2955+Motor+Avenue&city=Los+Angeles%2C&state=CA&zip=90064 |

| |

| |

|

****************************************************************** |

| |

FSA Tax Service (Mike), San Diego, CA on 4-21-2015

Regarding taxes on sale of my house at 2955

Motor Ave., Los Angeles, CA. If my LA house sells for $1,700,000

and the closing costs are 7% then the net sale price is: $1,581,000.

Taxes would be federal: 23%, California 12% or total of 35% of

taxable amount

Taxable amount is: 1,581,000 - 200,000 (price I paid for

house in 1979) - $250,000 deductible for single owner - $15,000

(improvements) - 23,000 (loan remaining) = $1,093,,000

Total taxes (Fed & California cap. gains + Obama Care) = 1,093,000 X 0.35

= $382,550

Net on sale of 2955 Motor

Ave. for $1.7 million is: 1,581,000 (after 7% closing costs) -

$382,550 (taxes)

$1,119,450

If 2955 Motor sells for $1,650,000 (offer already

received 12-2015): $1,534,500 (after 7% closing costs) -

$366,275 (taxes) = $1,168,225

If 2955 Motor sold for $1,000,000: $930,000 (after 7%

closing costs) - $164,500 (taxes) = $765,000

If 2955 Motor sold for $1,500,000: $1,395,000 (after 7% closing costs) -

$327,000 (taxes) = $1,068,000

To keep the same property tax for a new house in San Diego as 2955

Motor, one needs to buy the new house for less than the sale of the old

one (gross sale price) |

| |

| |

|

****************************************************************** |

| |

|

A. Kirsch tax rate if I sell my house in 2016

He got the information from his accountant:

M.N.

Woodland Hills, CA.

Federal tax rate for sale of my house at over $1,000,000

is 20% plus 3.8% = 23.8%

California state tax is 11.2%

Total tax rate is: 35%

Example 1: If my house sold for

$1,650,000 thru SN from the non-accepted offer of RS

Offer for my house: $1,650,000

Mortgage due: $22,000, Net equity: $1,650,000 - $22,000 = $1,628,000

Closing costs are $89,914 (4.5% commission, plus other fees)

The net before taxes is $1,628,000 - 89,914 = $1,538,086

Taxes would be Federal: 23.8% (20% + 3.8%), California 11.2% or total of

35% of taxable amount

Taxable amount is: 1,538,086 - 200,000 (price I paid for house in 1979) -

$250,000 deductible for single owner - $15,000 (improvements) = $1,073,086

Total 35.0% taxes (Fed & California) = 1,073,086 X 0.35 =

$375,580

So if my house sells for $1,650,000 ($1,628,000 after I

pay off the $22,000 mortgage), the Net after closing costs and taxes (35%)

is about $1,538,086 - 375,580

Net is $1,162,506

(or if tax rate is 35.8%, $384,165, then net would be

net $1,153,921)

******************************************************************************

Example 2: My guess estimate of net

if house sells for $1,500,000 (KK possible

offer on 1-19-2016) :

Offer (?) for my house: $1,500,000, Mortgage due: $22,000

Net equity: $1,500,000 - $22,000 = $1,478,000

If closing costs including commission is 7% it will be $103,346

If my LA house sells for $1,500,000 and the closing costs are $103,346

then the net before taxes is $1,478,000 - 103,346= $1,374,654

Taxes would be federal: 23.8%, California 11.2% or total of 35% of taxable

amount

If my LA house sells for $1,500,000, my mortgage pay-off $22,000 and the

closing costs are $103,346 then the net price is: $1,374,654.

Sum of Federal & State taxes would be 35% of taxable amount

Taxable amount is: 1,374,654 - 200,000 (price I paid for house in 1979) -

$250,000 deductible for single owner - $15,000 (improvements) = $909,654

Total taxes (Fed & California cap. gains + Obama Care) = 909,654 X 0.35 =

$318,379

So if my house sells for $1,500,000 with Kirt Kingzett

(after I pay off the $22,000 mortgage), the Net after closing costs and

taxes is about $1,478,000 - $318,379 (taxes) = $1,115,962

Net is $1,115,962 |

| |

| |

| |